When a company decides to raise money by selling its shares to the public for the first time, it’s called an Initial Public Offering, or IPO. In simple terms, an IPO is when a private company opens up ownership to the general public, allowing people to buy shares and become part-owners. In India, IPOs have become popular among investors because they offer a chance to get in early on companies that could grow significantly over time. However, investing in IPOs isn’t always easy; while some can lead to big profits, others may not perform as expected. This is why knowing what to look for before investing in an IPO is important.

One common mistake is assuming that a famous or popular company will automatically be a good investment. Sometimes well-known companies have financial issues but still see high demand for their IPO shares. These companies might perform well at first, often due to public interest and excitement, but they can still face challenges later on. Understanding why some well-known companies with weak financials still succeed in their IPOs can help you make smarter choices.

In this article, we’ll discuss the main things to consider when deciding if an IPO is a good investment. We’ll discuss important financial factors like revenue, profit, and debt, and how these can reveal a company’s health. We’ll also cover the demand for the IPO, how to check if big investors are interested, and what it means when an IPO is highly or lightly subscribed. Knowing these details can help you decide whether the IPO will likely succeed.

By the end of this article, you’ll understand how to analyze an IPO and decide if it’s a good fit for your investment goals. Whether you’re looking to invest for quick gains or hold onto shares for the long term, these insights will help you make informed decisions in India’s fast-growing IPO market.

Essential Terms to Know Before Investing in an IPO

Before diving into how to analyze IPOs, it’s important to understand some key terms that are commonly used in IPO discussions. Knowing these terms will make it easier to follow the analysis and help you feel more confident when reading about or investing in IPOs. Here’s a list of 25 essential terms:

Key IPO Terms Explained

- IPO (Initial Public Offering):

The process by which a private company sells its shares to the public for the first time, turning into a publicly traded company. - Shares:

Small units of ownership in a company. When you buy shares, you own a part of that company. - Public Company:

A company whose shares are available for anyone to buy on a stock exchange. - Private Company:

A company that is not listed on the stock exchange and whose shares are not available to the general public. - Underwriter:

A financial institution, like a bank, helps the company issue shares and manage the IPO process. They also help determine the price of the shares. - Prospectus:

A document issued by the company before the IPO gives details about the company’s business, financials, risks, and why it’s raising funds. Reading the prospectus is essential to understand the company. - Draft Red Herring Prospectus (DRHP):

The first version of the prospectus that companies submit to regulators (like SEBI in India) to get approval for an IPO. - SEBI (Securities and Exchange Board of India):

The regulatory body that oversees the Indian stock market. SEBI ensures that companies follow rules and protect investors’ interests. - IPO Price Band:

The price range within which the company plans to sell its shares. Investors can place bids within this range during the IPO. - Issue Price:

The final price at which the shares are issued to the public. It’s set within the IPO price band based on demand and underwriters’ input. - Lot Size:

The minimum number of shares that an investor must buy in an IPO. For example, if the lot size is 10, you must buy at least 10 shares. - Subscription Rate:

This shows how many times the IPO shares have been applied for compared to what’s available. A high subscription means more demand. - Oversubscription:

When more people want to buy the shares than are available. Oversubscribed IPOs often have high demand and may offer strong listing gains. - Listing:

The process of a company’s shares starting to trade on a stock exchange, such as the NSE or BSE in India. This is when you can buy or sell the shares in the open market. - Listing Gains:

The profits an investor makes from the difference between the issue price and the price at which shares are listed on the exchange. - Grey Market Premium (GMP):

An unofficial, “grey market” indicator of an IPO’s demand before it is listed on the stock exchange. A high GMP suggests strong interest, but it’s not an official measure. - Anchor Investors:

Large, institutional investors who buy shares before the IPO is offered to the public. Their participation can boost confidence in the IPO. - Retail Investors:

Individual investors, like everyday people, buy small amounts of shares in an IPO. There’s usually a quota for retail investors in an IPO. - Qualified Institutional Buyers (QIBs):

Large, professional investors like banks, mutual funds, and insurance companies that often buy large quantities of shares. - HNI (High Net-Worth Individual):

Wealthy investors who invest large sums in IPOs. They often have a separate quota in IPO allocations. - Price-to-Earnings (P/E) Ratio:

A valuation metric that shows how much investors are willing to pay for each rupee of a company’s earnings. A high P/E may mean investors expect high growth. - Price-to-Book (P/B) Ratio:

Another valuation metric that compares the company’s market value to its book value (assets minus liabilities). Lower P/B values can signal undervaluation. - Lock-in Period:

A set period after the IPO during which certain investors, like promoters or anchor investors, cannot sell their shares. This prevents sudden drops in share price after listing. - Allotment:

The process of distributing IPO shares to investors. When oversubscribed, not everyone may receive shares, and allotment is often done through a lottery for retail investors. - Cut-Off Price:

The final price at which shares are sold to retail investors. Choosing the cut-off price during bidding can increase your chances of getting shares in an oversubscribed IPO.

By familiarizing yourself with these terms, you’ll find it easier to understand the steps and tips for analyzing an IPO in India. These definitions provide the foundation for making sense of financial metrics, demand signals, and other factors that influence an IPO’s success.

Why Financial Health, Fair Valuation, and Market Position Matter for an IPO

When choosing an IPO to invest in, three main areas help you decide if the company is worth your money: its financial health, the fairness of its IPO price, and its position in the market. Understanding these factors makes it easier to spot promising IPOs and avoid overpriced or risky ones.

1. The Importance of Financial Health

Knowing a company’s financial health is like checking its “money strength.” Here’s why it matters:

- Revenue and Profit Trends: If a company’s income (revenue) and profits have been growing steadily over time, it shows that it has a stable and successful business. This stability is a good sign for investors.

- Debt Levels: Debt is the money a company owes. Low debt is often better because it means the company doesn’t have to spend too much of its income paying back loans. High debt can be risky, especially if the company’s profits aren’t enough to cover it.

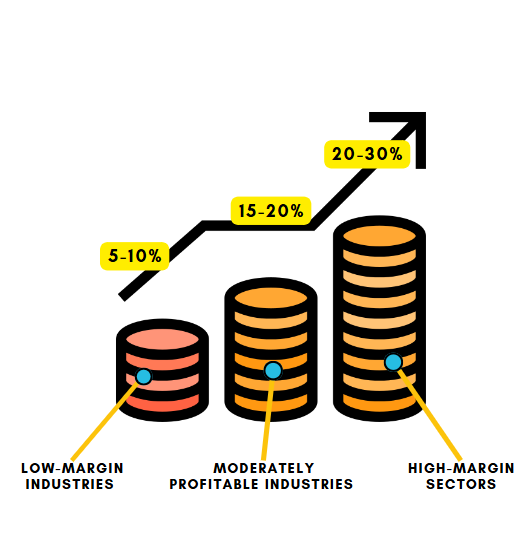

- Profit Margins: Profit margins show how much money the company keeps after covering all its costs. Higher profit margins mean the company is better at keeping profits and managing expenses.

A company with strong financial health is more likely to succeed and grow after its IPO, giving investors confidence.

2. Valuation: Knowing If the IPO Price Is Fair

The valuation of an IPO shows whether the price set for shares is reasonable based on the company’s worth. Here’s why it’s important:

- Price-to-Earnings (P/E) Ratio: The P/E ratio tells you how much investors are paying for each unit of the company’s earnings (profits). If the P/E ratio is too high, it might mean the company is overpriced. Comparing it to other similar companies helps see if the price is fair.

- Price-to-Book (P/B) Ratio: This metric compares the IPO price to the company’s actual assets. A lower P/B can mean a better value, as it indicates the stock price is lower than the company’s book value. High P/B values can be okay if there’s a strong reason, like high growth.

- Earnings Growth: This shows how much the company’s earnings have grown over time. High growth often means the company has good potential, which can justify a higher IPO price. But if growth is weak, the IPO might be overpriced.

In simple terms, valuation helps you see if the company’s price is reasonable for what it offers. A fair valuation means a better chance of long-term returns.

3. Understanding the Industry and Market Position

A company’s place in its industry and how it stacks up to competitors is key to its success after the IPO. Here’s why this matters:

- Industry Growth Potential: Companies in growing industries, like technology or green energy, have more opportunities for success. Knowing the industry’s future growth helps you understand if the company can keep expanding and attracting more customers.

- Competitive Edge: If the company has something unique — a popular brand, a big market share, or special technology — it has an advantage over competitors. A strong edge can help it succeed and stay profitable.

- Regulatory Environment: Some industries, like banking or healthcare, have strict government rules. These rules can limit a company’s growth, so it’s important to consider if there are regulations that could slow the company down.

Knowing the company’s market position helps you understand its potential to grow, even in tough times. A strong position in a growing industry is often a good sign.

Why Demand, Subscription Levels, and Promoters Matter for an IPO Investment

When you’re thinking about investing in an IPO, looking at how many people want to buy the shares (demand and subscription levels) and who’s leading the company (promoters) can be just as important as the company’s financial details. Here’s why these factors matter:

1. Demand and Subscription Levels: Seeing How Popular the IPO Is

- Shows Market Interest: If an IPO is highly subscribed (meaning more people want to buy shares than there are shares available), it often shows strong interest and excitement about the company. This popularity can lead to good returns once the stock starts trading.

- Indicates Long-Term Potential: When big investors like banks or mutual funds (often called Qualified Institutional Buyers or QIBs) show high interest, it’s usually a good sign. These investors usually focus on the long-term, so their strong interest can mean they see growth potential.

- Warns of Possible Risks: Low subscription, or fewer people wanting the shares, can be a warning sign. It might mean there are concerns about the company’s future, so it’s worth considering why there’s low demand before investing.

2. Promoters: Knowing Who’s Behind the Company

- Trust and Stability: Promoters are usually the founders or key leaders in the company. If the promoters have a strong, positive track record of running successful businesses, it can make investors feel more confident that the company will be managed well.

- Commitment to the Company: If promoters keep a large share of the company after the IPO, it shows they are still committed to its future. This commitment often means they’ll work hard to make the company successful, which can benefit investors.

- Watch Out for Red Flags: If promoters have a history of legal problems or bad practices, it’s a risk for investors. Poorly regarded promoters might make decisions that harm the company’s reputation and stability, which could lead to price drops in the stock.

Looking at how popular an IPO is with different types of investors and checking who’s behind the company gives you important clues about whether it’s a good investment. High demand and respected promoters can mean more safety and potential growth, while low interest or questionable leadership might suggest caution.

Why Strong Brands with Weak Financials Can Give Higher Gains in an IPO

Companies like Zomato, Nykaa, and Tata Technologies often attract more attention and deliver high returns, even if their financials aren’t the strongest. Here’s why:

1. Investor Confidence and Brand Trust

A strong brand creates confidence. Companies like Zomato or Tata have established names that people recognize and trust. This familiarity makes investors feel safer betting on them, even if the company’s financials aren’t impressive. Investors believe that these well-known companies are more likely to overcome financial challenges and eventually become profitable, making their shares more valuable in the future.

2. Growth Potential and Market Leadership

Strong brands are often leaders or pioneers in their industry. For instance, Zomato is one of the top food delivery platforms, and Nykaa has become a go-to name for beauty products. Investors see these companies as having high growth potential because they’re already capturing large portions of their markets. Even if they’re not currently profitable, the expectation is that their growth will eventually bring in big profits.

3. Emotional Appeal and FOMO (Fear of Missing Out)

Brand power can create emotional appeal. Investors don’t want to miss out on popular companies that are constantly in the public eye. This Fear of Missing Out (FOMO) drives demand, especially during the IPO phase. Well-known brands are discussed in the media, on social platforms, and among friends, building excitement that can boost share prices in the short term.

4. Future Profit Potential Despite Present Losses

Many high-growth companies sacrifice profits early on to grow their market share and brand recognition. Investors expect that these companies, once they stabilize and reach a larger customer base, will shift focus to profits. The idea is that their current losses are part of a strategy to dominate the market, which could lead to strong profits later.

5. Valuation Driven by Brand Power

Strong brands can command higher valuations than lesser-known companies with similar or even better financials. Investors are willing to pay more for shares of well-known companies, often leading to a price surge after the IPO. This boost doesn’t always correlate with financial health; instead, it’s based on the perceived future potential that a strong brand brings.

In Simple Terms

Companies with a popular brand, like Zomato or Nykaa, can give high returns because people trust and believe in the brand, even if the financials aren’t great right now. These brands have strong growth potential, and investors don’t want to miss out on them. The idea is that these companies will turn profitable in the future, making the investment worthwhile.

Using Case Studies to Understand IPO Success, Overhype, and Turnaround Potential

Looking at past IPOs can teach us a lot about what to watch for when choosing companies to invest in. Here, we’ll explore examples of successful IPOs like DMart and Infosys, overhyped IPOs such as Paytm and Vodafone Idea, and turnaround stories where companies improved over time to reward patient investors.

1. Successful IPOs: DMart and Infosys

Some IPOs succeed because they tick all the right boxes: a solid business model, steady growth, and a trustworthy team. DMart and Infosys are great examples of this.

- DMart (Avenue Supermarts): DMart entered the market in 2017 and quickly became one of India’s most successful retail chains. Its simple business model focused on efficiency, low costs, and consistent growth, which made investors feel confident. DMart’s smart approach and strong position in India’s growing retail market led to a big increase in stock value after its IPO, rewarding its investors.

- Infosys: Infosys, a leader in Indian IT, went public in 1993. The company had a strong plan for growth and a dedicated team. It was one of the first Indian tech companies to break into global markets, and it quickly expanded. Infosys’s innovative mindset and consistent growth over the years have made it a favourite for long-term investors, with strong returns since its IPO.

Key Lesson: Companies like DMart and Infosys show how having strong business fundamentals, a good team, and steady growth can help IPOs succeed and continue delivering gains for investors.

2. Overhyped IPOs: Paytm and Vodafone Idea

Sometimes, a popular brand creates a lot of excitement for an IPO, but if the company’s finances aren’t solid, it may disappoint investors later. Paytm and Vodafone Idea are good examples of this.

- Paytm: In 2021, Paytm’s IPO was widely anticipated, mostly because of its fame as a top digital payment platform in India. But Paytm was still running at a loss, and there was no clear path to profitability. Investors were excited initially, but without a stable financial base, the stock value fell soon after the IPO, leaving many disappointed.

- Vodafone Idea: Vodafone Idea’s IPO also generated buzz due to its strong brand in telecom. However, the company was heavily in debt and facing tough competition. Without strong financial health and with high costs, Vodafone Idea’s stock underperformed, showing that a famous brand doesn’t always mean a good investment.

Key Lesson: Overhyped IPOs like Paytm and Vodafone Idea show that a strong brand doesn’t guarantee success. Companies need solid financials and a clear growth plan to perform well in the market.

3. Turnaround IPOs: Rewards for Patient Investors

Sometimes, IPOs start slow due to financial struggles, but with time, smart management and strategic changes can lead to a successful turnaround. Bharti Airtel and Wipro are examples of companies that rewarded investors who stayed patient.

- Bharti Airtel: In the beginning, Airtel faced big challenges with high debt and tough competition. However, the company improved its services, invested in data growth, and managed its costs better. Over time, this strategy paid off, and investors who stuck with Airtel saw strong returns as the company grew into a leader in telecom.

- Wipro: Wipro initially had a mixed focus, ranging from consumer goods to tech services. However, when it shifted its focus to IT services, the company gained stability and growth. Wipro’s commitment to tech helped it become one of India’s top IT companies, rewarding early investors with impressive returns over time.

Key Lesson: Turnaround IPOs like Bharti Airtel and Wipro show that companies with early struggles can still succeed if they adapt and grow. Patient investors can benefit if they trust in the company’s long-term vision.

Basically

Each of these case studies—successful, overhyped, and turnaround IPOs—teaches us something valuable. Successful IPOs show the importance of financial stability and growth potential. Overhyped IPOs remind us that popularity alone isn’t enough without solid fundamentals. Turnaround IPOs prove that companies with a rough start can still deliver strong gains for investors who are willing to wait. By learning from these examples, we can make smarter choices when investing in IPOs.

How Valuation, Financials, and Brand Image Affect IPO Returns

This table breaks down the potential outcomes of investing in IPOs based on three critical factors: Valuation, Financials, and Brand Image. By analyzing how these factors interact, investors can get a clearer idea of which IPOs are likely to yield strong returns and which might carry higher risks.

| Criteria | High Valuation | Low Valuation |

|---|---|---|

| Strong Financials & Strong Brand Image | Likely Positive Returns: A high valuation may slow initial growth, but strong financials and brand trust often lead to steady gains. | Good Returns Expected: A strong brand with a low valuation often leads to high investor interest, with the potential for strong gains as the company stabilizes. |

| Strong Financials & Weak Brand Image | Moderate Returns: Although less popular, the company’s strong financial health could lead to stable returns if the brand grows. | Potential for High Returns: Undervalued stock with healthy financials is attractive; as the brand builds, so does growth potential. |

| Weak Financials & Strong Brand Image | Can Give Good Returns: While financials may be weak, a strong brand image attracts more subscribers and investors, boosting demand and short-term growth. | Good Returns Expected: A strong brand with low valuation often leads to high investor interest, with the potential for strong gains as the company stabilizes. |

| Weak Financials & Weak Brand Image | High Risk of Loss: Limited appeal and high valuation with poor financial health usually lead to low demand and poor returns. | Low Returns Expected: With little market appeal and weak financials, undervaluation offers minimal growth prospects. |

Explanation:

- High Valuation: Even with weak financials, a strong brand image can still lead to good returns in the short term due to high demand driven by brand loyalty and consumer recognition. Investors may be willing to overlook weak financials because of the brand’s perceived future potential.

- Low Valuation: When the stock is undervalued, the strong brand image can lead to increased demand and strong returns, especially as investors expect the company to turn around financially with time.

Conclusion: Making Smarter IPO Investment Decisions

Investing in an IPO can be an exciting way to enter the stock market, but it’s important to think carefully before making a decision. As we discussed, factors like valuation, financial health, and brand image all play a big role in determining how well an IPO will perform. A high valuation might seem attractive, but it can limit growth, especially if the company doesn’t have strong financials. On the other hand, a low valuation can be a good opportunity for growth, but only if the company is financially strong or has room to improve.

Financial health is one of the most important things to consider when evaluating an IPO. Companies with strong financials are more likely to grow steadily and avoid major losses. But sometimes, a company with a weak financial background can still perform well if it has a strong brand. A well-known brand can attract a lot of attention from investors and customers, even if the financials aren’t great at first. This demand can help push the stock price up in the short term.

The market doesn’t always react based on financials alone. Public perception and the excitement around a brand can greatly influence how an IPO performs. Big brands like Zomato or Nykaa, despite having weak financials at times, can still do well because people trust them and want to be part of their growth. As a result, the stock might see strong demand during the IPO, even if the company’s numbers aren’t perfect.

To sum up, investing in IPOs requires more than just looking at a company’s financials or brand value. You need to carefully think about its overall health, potential for growth, and the market’s interest in it. By doing your research and understanding the key factors, you can make better decisions and increase your chances of success in IPO investments.