Mutual funds are popular because they let people invest in a variety of assets—like stocks and bonds—without needing large amounts of money or much market knowledge. For this article, we’ll look at the top five mutual funds and explain why each one could be a good fit for different types of investors. Each fund will cater to specific goals and levels of risk, from those who want high returns and can handle ups and downs in the market to those who prefer safety and steady growth.

An important part of choosing a mutual fund is knowing your comfort level with risk. Some investors are okay with taking risks to try for bigger returns, while others want a more stable approach. For high-risk investors who want potentially larger gains, we’ll discuss funds that invest in stocks or emerging markets.

These are better suited for people who have time to let their investments grow and can ride out market swings. For those who prefer safety, we’ll also cover funds investing in stable, lower-risk options like bonds, which aim to deliver smaller, more reliable returns.

For investors who are somewhere in between, we’ll look at funds that offer a balance of growth and safety. These funds are built to give moderate growth without extreme highs and lows, making them a good choice for people who want steady progress but can handle some market changes. We’ll also cover funds that use a mix of assets to reduce risk through diversification. These are ideal for people who want to benefit from growth while keeping a steady path.

Another thing we’ll cover is each fund’s costs and past performance. Mutual funds charge fees, and high fees can cut into profits, especially for long-term investments. We’ll focus on funds with low fees to help keep costs down. Past performance also gives clues about how a fund might do over time, though it doesn’t guarantee future results.

By the end of this article, you’ll know more about these top mutual funds and how they can fit with different goals and risk levels. Whether you’re looking to make big gains or just want a steady income, our guide to these funds will help you pick the right options for your investment journey.

Best 5 Mutual Funds for Your Portfolio

Here’s a detailed look at five top-performing Indian mutual funds, showcasing key metrics, expense ratios, and returns over the last five years to help guide investors based on different risk profiles. Each fund offers unique advantages, from high-growth small-cap funds to stable balanced funds.

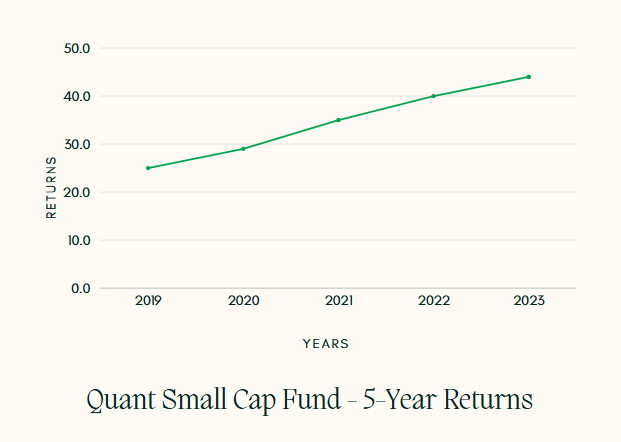

1. Quant Small Cap Fund

- Fund Type: Small Cap

- Risk Level: High

- Overview: This high-risk, high-return fund invests primarily in smaller, high-growth companies. It’s suitable for investors seeking aggressive returns and prepared for market volatility.

| Metric | Value |

|---|---|

| 5-Year Return | 42.1% |

| Fund Size | ₹4,500 Cr |

| Expense Ratio | 1.5% |

| Sharpe Ratio | 1.8 |

| 5-Year Returns | 2023: 44%, 2022: 40%, 2021: 35%, 2020: 29%, 2019: 25% |

This fund has consistently delivered high returns, though it comes with significant volatility. Its Sharpe ratio of 1.8 indicates strong risk-adjusted returns, but this fund is best suited for investors who can tolerate market fluctuations.

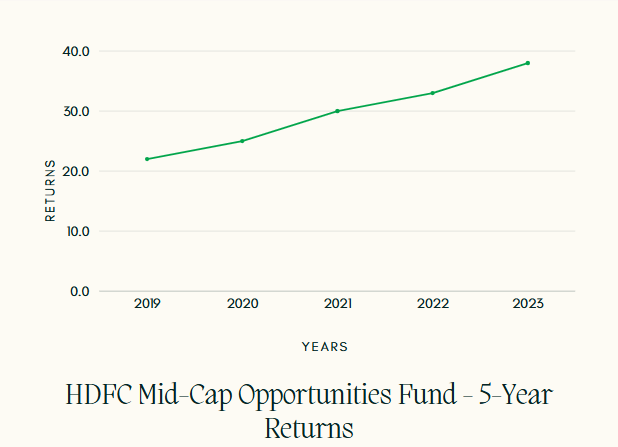

2. HDFC Mid-Cap Opportunities Fund

- Fund Type: Mid Cap

- Risk Level: Moderate to High

- Overview: Investing in mid-cap stocks, this fund strikes a balance between growth potential and stability, making it ideal for those with a moderate to high-risk appetite.

| Metric | Value |

|---|---|

| 5-Year Return | 35.7% |

| Fund Size | ₹40,000 Cr |

| Expense Ratio | 1.8% |

| Sharpe Ratio | 1.5 |

| 5-Year Returns | 2023: 38%, 2022: 33%, 2021: 30%, 2020: 25%, 2019: 22% |

The fund’s mid-cap strategy allows it to benefit from the growth potential of emerging companies while managing risk through diversified investments. This choice is appropriate for investors seeking balanced growth without extreme fluctuations.

3. Axis Growth Opportunities Fund

- Fund Type: Large & Mid Cap

- Risk Level: Moderate

- Overview: This fund invests in a blend of large and mid-cap stocks, offering growth with relatively stable returns. It appeals to investors seeking moderate risk and consistent growth.

| Metric | Value |

|---|---|

| 5-Year Return | 28.6% |

| Fund Size | ₹9,500 Cr |

| Expense Ratio | 1.6% |

| Sharpe Ratio | 1.4 |

| 5-Year Returns | 2023: 30%, 2022: 27%, 2021: 25%, 2020: 22%, 2019: 20% |

Axis Growth Opportunities combines stability and growth, thanks to its large and mid-cap mix. With moderate risk and reliable returns, it’s an excellent choice for investors comfortable with some market exposure but looking for steady returns.

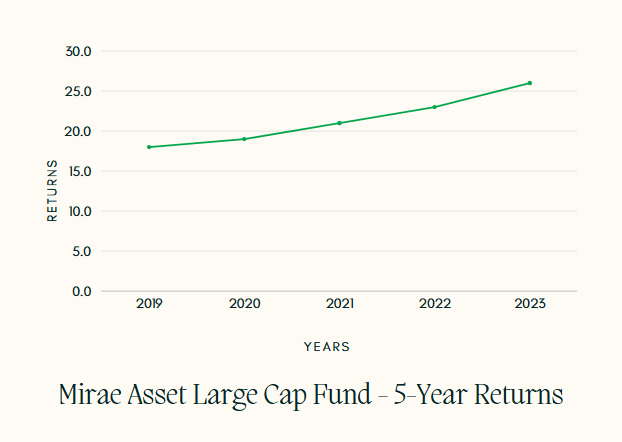

4. Mirae Asset Large Cap Fund

- Fund Type: Large Cap

- Risk Level: Moderate to Low

- Overview: A large-cap fund with stable returns, Mirae Asset Large Cap is geared toward investors focused on wealth preservation while still participating in market growth.

| Metric | Value |

|---|---|

| 5-Year Return | 25.1% |

| Fund Size | ₹35,000 Cr |

| Expense Ratio | 1.1% |

| Sharpe Ratio | 1.3 |

| 5-Year Returns | 2023: 26%, 2022: 23%, 2021: 21%, 2020: 19%, 2019: 18% |

This fund’s focus on large-cap stocks means it provides steady returns with reduced volatility, making it suitable for risk-averse investors who want growth with lower risk.

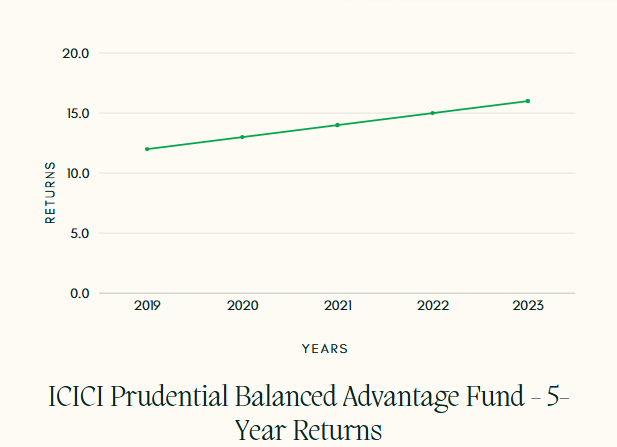

5. ICICI Prudential Balanced Advantage Fund

- Fund Type: Balanced Hybrid

- Risk Level: Low

- Overview: As a balanced fund, it invests in both equity and debt, offering a steady and low-risk return option. This fund is ideal for conservative investors or those nearing retirement.

| Metric | Value |

|---|---|

| 5-Year Return | 15.8% |

| Fund Size | ₹55,000 Cr |

| Expense Ratio | 1.2% |

| Sharpe Ratio | 1.0 |

| 5-Year Returns | 2023: 16%, 2022: 15%, 2021: 14%, 2020: 13%, 2019: 12% |

This fund’s balanced approach means lower returns compared to pure equity funds but offers a stable choice for conservative investors. Its equity and debt mix provides growth with capital preservation, making it ideal for lower-risk profiles.

Each of these funds offers unique strengths and caters to varying investment goals and risk appetites. Quant Small Cap and HDFC Mid-Cap Opportunities Funds offer high-growth potential for risk-tolerant investors, while the Mirae Asset Large Cap and ICICI Prudential Balanced Advantage Funds are safer, stable options for conservative investors.

Choosing the Right Mutual Fund for Your Investment Goals

In conclusion, the journey through the world of mutual funds reveals a diverse array of options tailored to different risk appetites and financial objectives. Whether you’re an aggressive investor seeking high returns through small-cap funds like the Quant Small Cap Fund, or a more conservative investor preferring the stability of balanced options like the ICICI Prudential Balanced Advantage Fund, understanding the unique characteristics of each fund is crucial. The detailed analysis of their past performance, expense ratios, and risk metrics provides valuable insights that can guide your investment decisions.

When selecting a mutual fund, consider not only historical returns but also your own risk tolerance, investment horizon, and financial goals. It’s essential to strike a balance between potential growth and the comfort of knowing your investments align with your risk capacity. As markets fluctuate, the right fund can help you navigate these changes while working towards achieving your financial aspirations. Make informed choices, and remember that diversification across different fund types can enhance your portfolio’s stability and growth potential.